We keep our ear to the ground for the interesting stats, insights and discussion points you need to feel in the know.

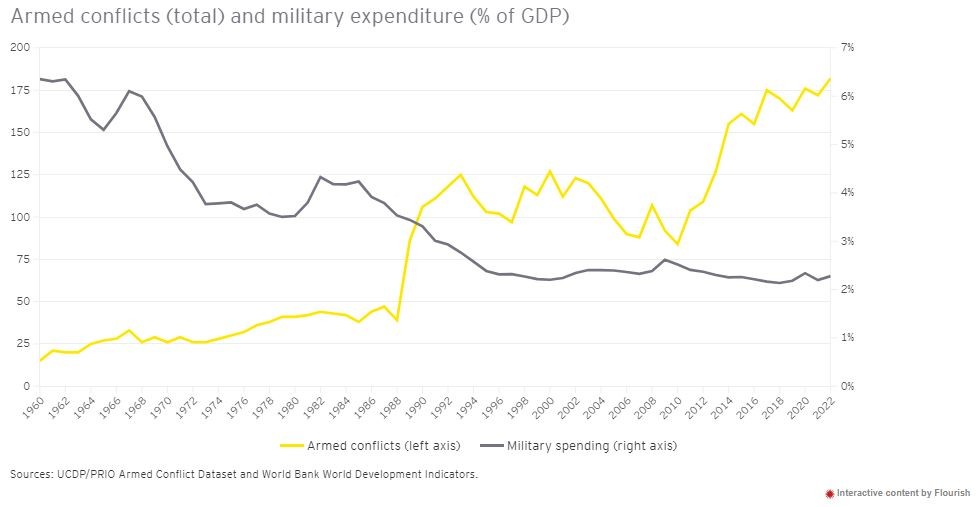

1. Increasing violence and what it means for business

The level of violence and the number of armed conflicts worldwide has risen dramatically in recent years. But despite that, the level of official military spending has remained relatively flat as a share of GDP. This might seem like a contradiction. However, it may be explained by the trend of geopolitical power becoming increasingly fragmented, with smaller actors trying to change the status quo; both within their own country and across their broader region. With this trend likely to continue, what impact could it have on business? Conflict in locations where companies operate raises several challenges. These include the safety of employees and damage to physical facilities. Armed conflicts can also disrupt companies’ operations and supply chain, both directly and indirectly. Companies also have to think through the reputational risks of operating in conflict zones. More on upcoming political risk events and what they mean for global business…

Geostrategic Analysis: March 2024 edition

2. The «greenium» advantage

More than 50,000 organizations globally will need to begin disclosing information about their environmental, social, and governance (ESG) practices as early as 2025. And those mandated to report, will have to share more sustainability-related information than ever before. This increased importance of ESG has placed a spotlight on green and sustainable financing. Green bonds (which are just like regular bonds but the money raised exclusively finances climate projects) are growing in popularity, as they represent an appealing path for private and public companies to access capital for green investments. Companies looking to amplify the value of their listing by issuing green bonds, often gain a «greenium» (green premium) advantage; receiving more favorable financing terms based on their commitment to ESG principles. By integrating ESG into their core functions, as well as the fabric of their culture, businesses can contribute to a more sustainable future and unlock new avenues for capital…

3. The inconvenient truth about AI

AI’s emergence as a transformative power in various sectors from healthcare to finance is undeniable. But this bright future is clouded by an inconvenient truth: not everyone is on an equal footing in this digital race. While affluent students enjoy the benefits of AI-enhanced education, their counterparts in less privileged areas can face a starkly different reality, according to research by Jisc. For example, students that pay for Chat GPT Plus get access to faster, up-to-date and more reliable tech. Similarly, research by Oriel Squarerevealed that the use of AI for schoolwork in private schools was almost double that of state schools. This divide is more than a matter of access to technology; it’s a barrier to opportunity and a potential blockade to future employment in an increasingly AI-driven world. At the EY Foundation, we want to ensure all young people are equipped with the skills to thrive in this new era…

How does AI impact social mobility?

4. Gold fever… but is it sustainable?

The gold industry’s carbon footprint accounts for approximately 0.4% of global annual emissions, according to the World Gold Council (WGC). This might seem small – but it is not insignificant. Particularly considering the annual demand for gold has increased 17% year over year to 4,699 t in 2022, reaching an 11-year high. While the holding of physical gold isn’t associated with emissions, investors do often question whether they are responsible for emissions resulting from the wider gold supply chain. Gold is of course a mined product, with associated emissions predominantly coming from the generation and consumption of electricity. But there is good news. Mining operations are transitioning from fossil fuel-based power, to renewable. And when it comes to sustainability reporting, miners are actively tracking and analyzing high-quality ESG data. Another example; Canadian gold miner Mayfair Gold purchased carbon offsets for 738 t CO2 equivalent (CO2e) GHG emissions produced, thereby making its Fenn-Gib gold exploration project carbon neutral. Next steps for miners steering the transition…

How gold miners can build long-term competitiveness

5. The overlooked strength of a CMO

Twenty-five years ago, the big decisions for CMOs were how to best deploy a one-to-many campaign across a limited number of offline channels. Now consumers expect one-to-one engagement across any channel, anytime. And the learning curve is steep; from the metaverse and machine learning, to generative AI (GenAI) and extended reality. We don’t need CMOs to be data scientists. But CMOs do need a vision for what technology can do for them; the most obvious area being GenAI. Many forward thinking CMOs are looking to the technology to “times ten” their productivity. ChatGPT is proving a useful tool to generate captions, based on brand voice and personality, for social media platforms and has been successfully applied by one brand to create a “virtual concierge” that can answer customer queries. Other brands are collaborating with high-end photographers and AI image generator tools to produce fresh campaign images. As the consumer landscape changes, meaningful human connections are the ultimate currency. And as human-centered storytellers, companies can certainly lean on their CMOs…

If you do one thing:

Embrace your humanity and offer someone a listening ear.

Don’t miss a must read, find all the issues of the weekly must reads newsletter by EY on LinkedIn here.